Summary

Given its strong potential, the Queensland economy should be doing much better than it is, particularly regarding its business and housing investment levels. Furthermore, the state has not had the rebound in manufacturing that Palaszczuk suggested at her final media conference. Besides health care and social assistance, mining has been Queensland’s stand-out industry, but it’s been in and out of favour with the government. There were some positive economic developments during Palaszczuk’s term, particularly the fall in the unemployment rate. Still, overall the record was disappointing, and some big challenges emerged in our former Premier’s final term.

Introduction

It’s extraordinary how quickly the coup earlier this month against Annastacia Palaszczuk unfolded. She was at least equal to Beattie in political savvy and to Sir Joh in cunning. It’s still somewhat surprising that she’s now gone. That said, I recognise the state’s multiple crises in youth crime, housing and homelessness, and hospital ramping played a role in her downfall.

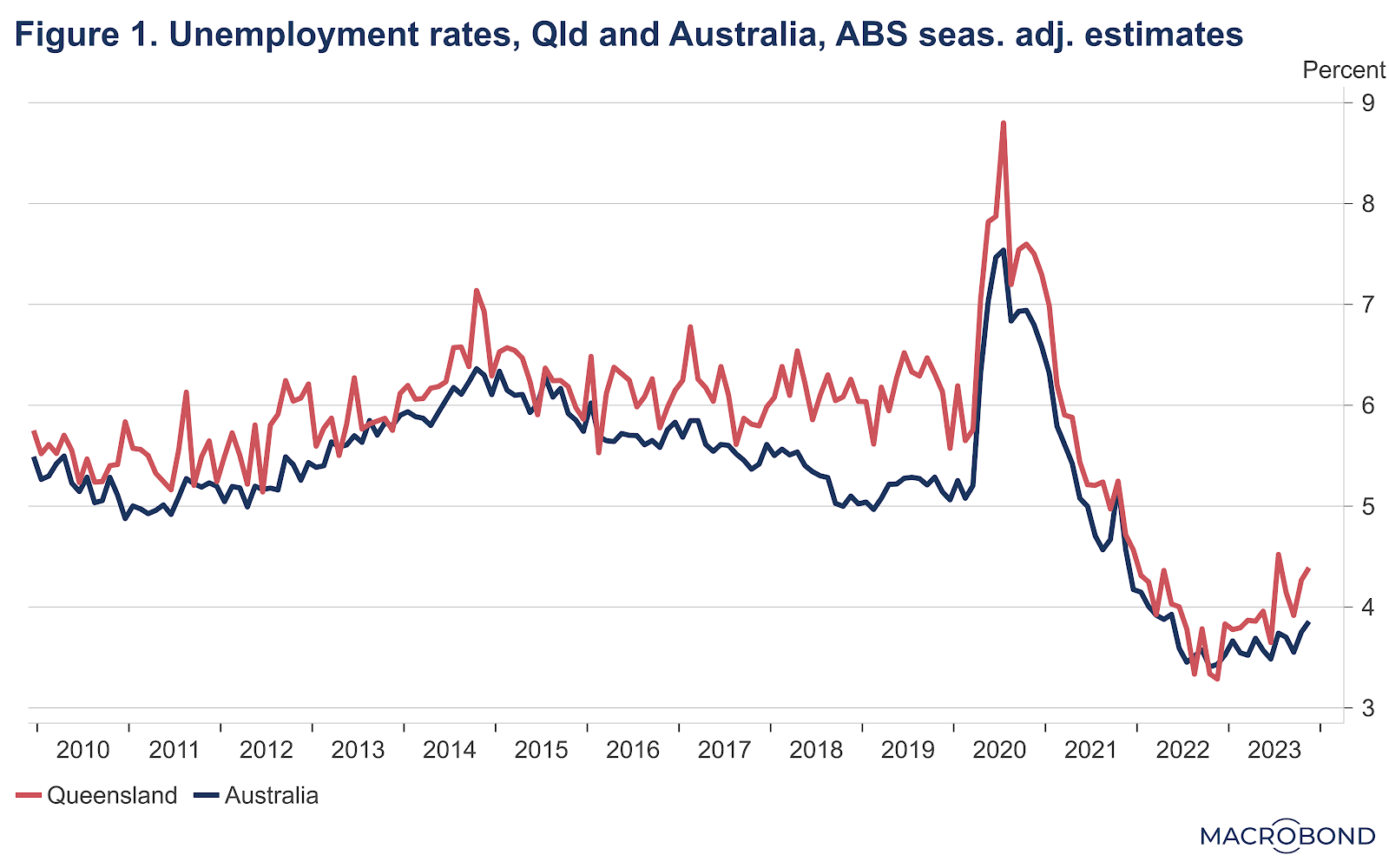

What I found interesting about Palaszczuk’s resignation speech was her mention of economic issues. She correctly spoke about Queensland’s much lower unemployment rate than when she took office in February 2015 (Figure 1). Of course, that’s more to do with national economic factors, such as the strong nationwide recovery from the pandemic, than anything her government did. Also, Queensland’s unemployment rate is increasing faster than the national rate as the economy slows. In November, Queensland’s seasonally adjusted unemployment rate was 4.4% compared with 3.9% nationally.

Has manufacturing been the success story Palaszczuk claimed?

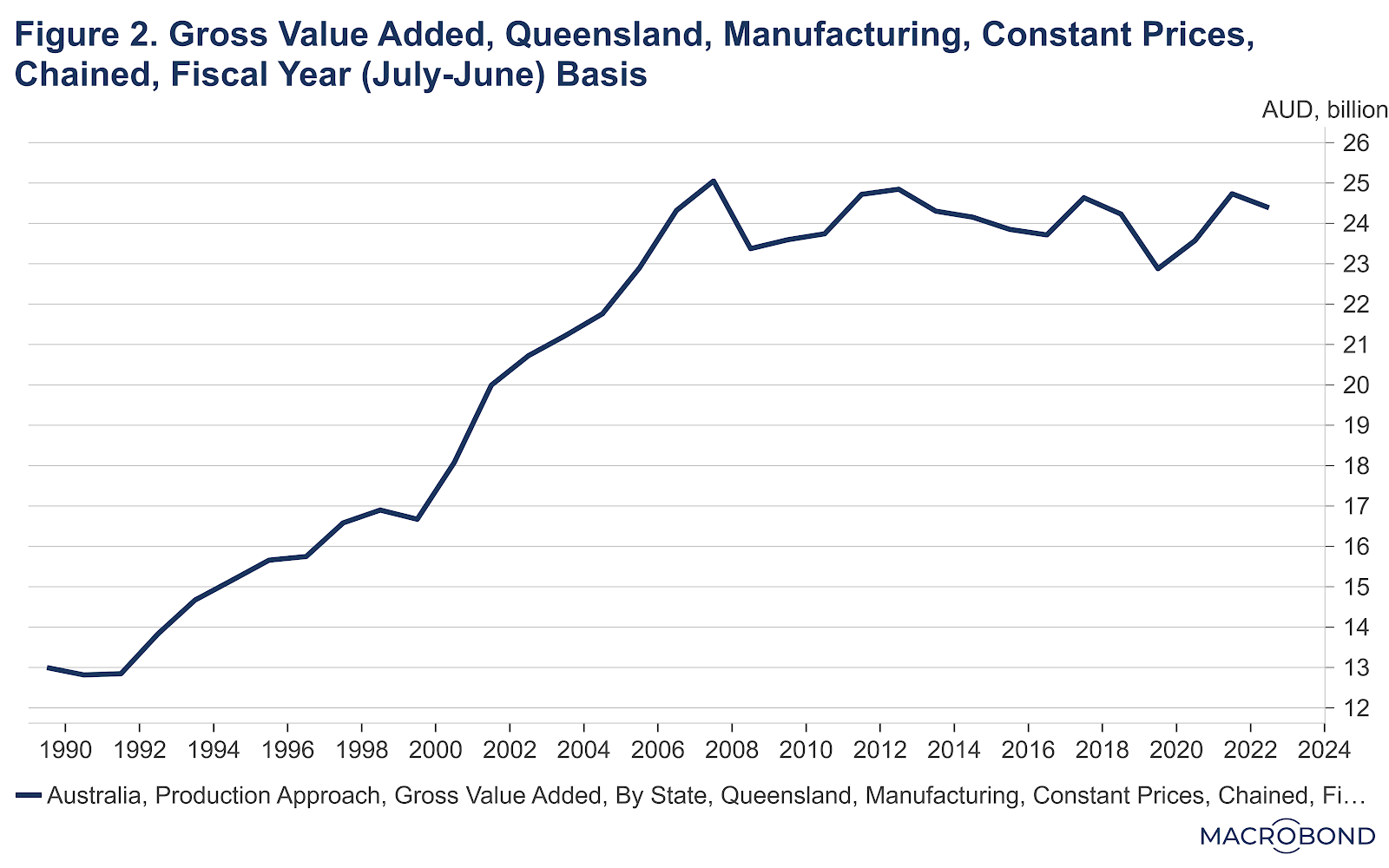

One of the former Premier’s claims that surprised me related to the manufacturing sector. “We’ve started making things in Queensland again, like trains at Maryborough,” she said, according to the Brisbane Times. The suggested expansion in Queensland manufacturing is questionable. Queensland’s manufacturing sector has barely grown since 2015. In relative terms, it has declined. According to ABS estimates, it was only 1% larger in real terms in 2022-23 than in 2014-15, and it’s still below its peak in 2007-08 (Figure 2). Because manufacturing has treaded water while other sectors have expanded, its share of Queensland’s Gross State Product fell from 6.7% in 2014-15 to 5.4% in 2022-23.

The best Palaszczuk can claim is that despite the meagre growth in manufacturing (i.e. 1% vs 22% all-industries growth), Queensland has outperformed the rest of Australia. Nationwide, the manufacturing sector has shrunk by 0.8% since 2014-15 and is 10% below its peak in 2007-08, after which Australia’s car manufacturers started shutting down.

The state government has not given mining the credit it deserves

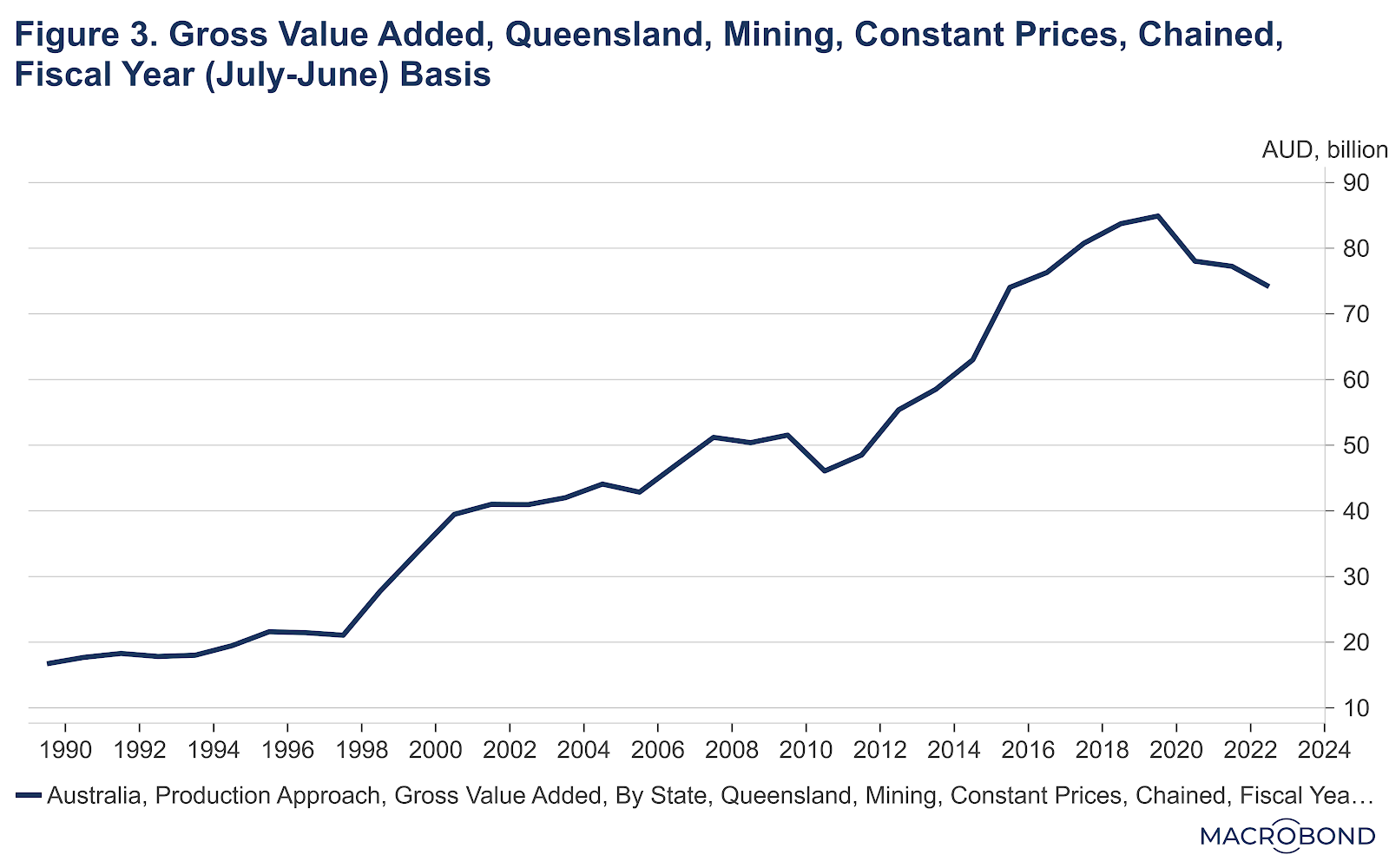

Incidentally, besides health care, which was in the number one position, mining contributed the most to Queensland’s economic growth over the Palaszczuk Government period, increasing in real value-added terms by $11.1 billion or 17.7% between 2014-15 and 2022-23 (Figure 3). The strong upward trend is evident despite a decline over the last few years. I’m unsure exactly why mining gross value added peaked in real terms in 2019-20. Partly it may be due to the China ban on Australian thermal coal or a quirk of the ABS’s procedure for producing chain volume estimates. I’ll look into this further and provide an update if I can figure out exactly what’s happening.

Given the hot-and-cold relationship between the state government and the sector, the government’s reliance on mining for economic vigour and strong royalty revenues is ironic. Former resources minister Anthony Lyneham was a very good minister, but he faced strong opposition to any new mining from the left of his party. To Palaszczuk’s credit, she eventually pushed through the Carmichael mine against formidable internal opposition. But she didn’t object to her Treasurer’s coal royalty hike. The unexpected colossal revenue grab was not good for business confidence in the stability of our policy settings.

Queensland needs to lift business and housing investment urgently

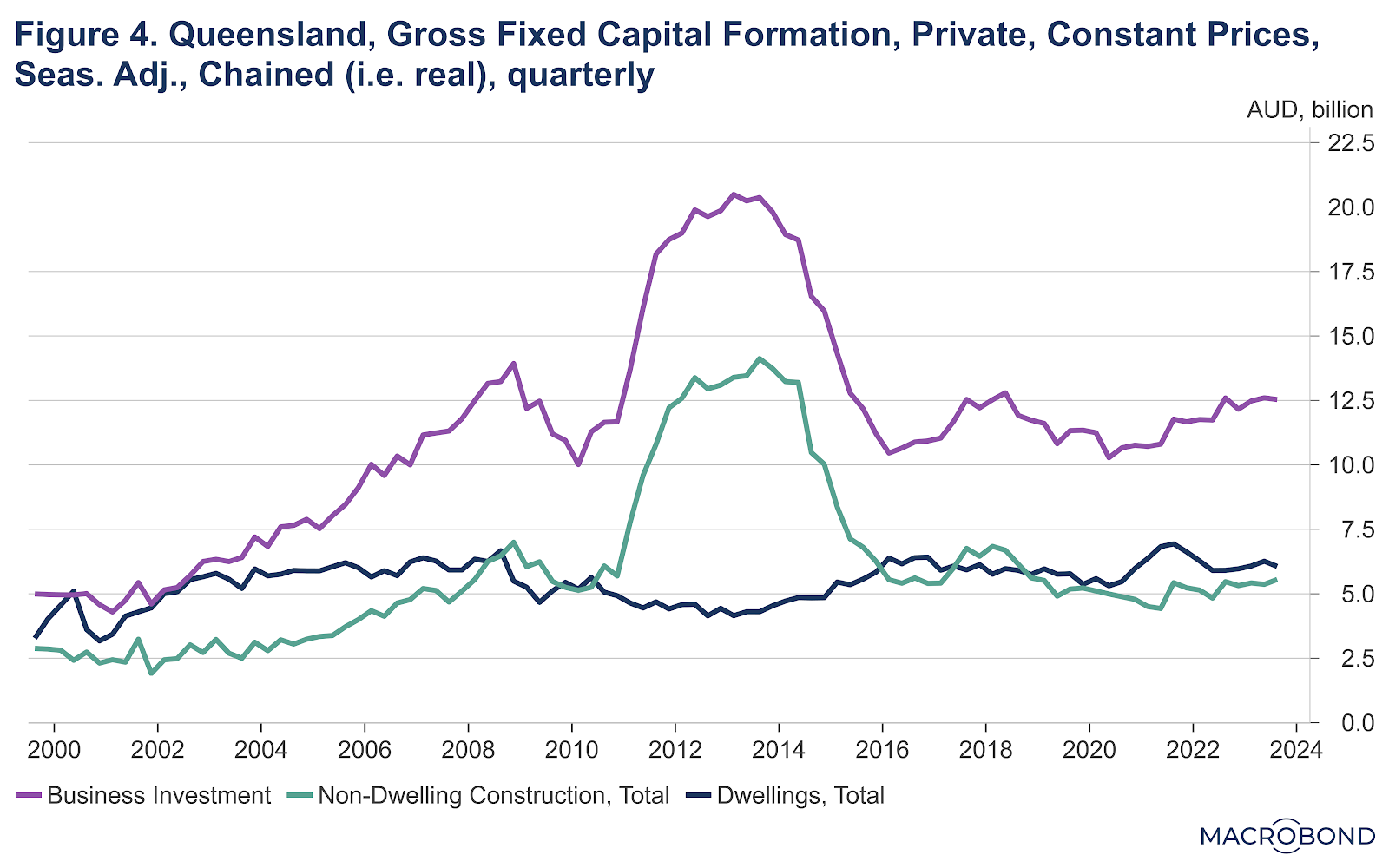

Queensland needs a boost in private sector investment, which has been disappointing since 2015. The massive CAPEX associated with the Curtis Island LNG projects distorts the figures, but they still show private sector investment in Queensland has plateaued in Queensland in recent years (Figure 4). Despite an ever-growing population, the level of private sector investment is comparable to before the 2008 financial crisis–a decade and a half ago.

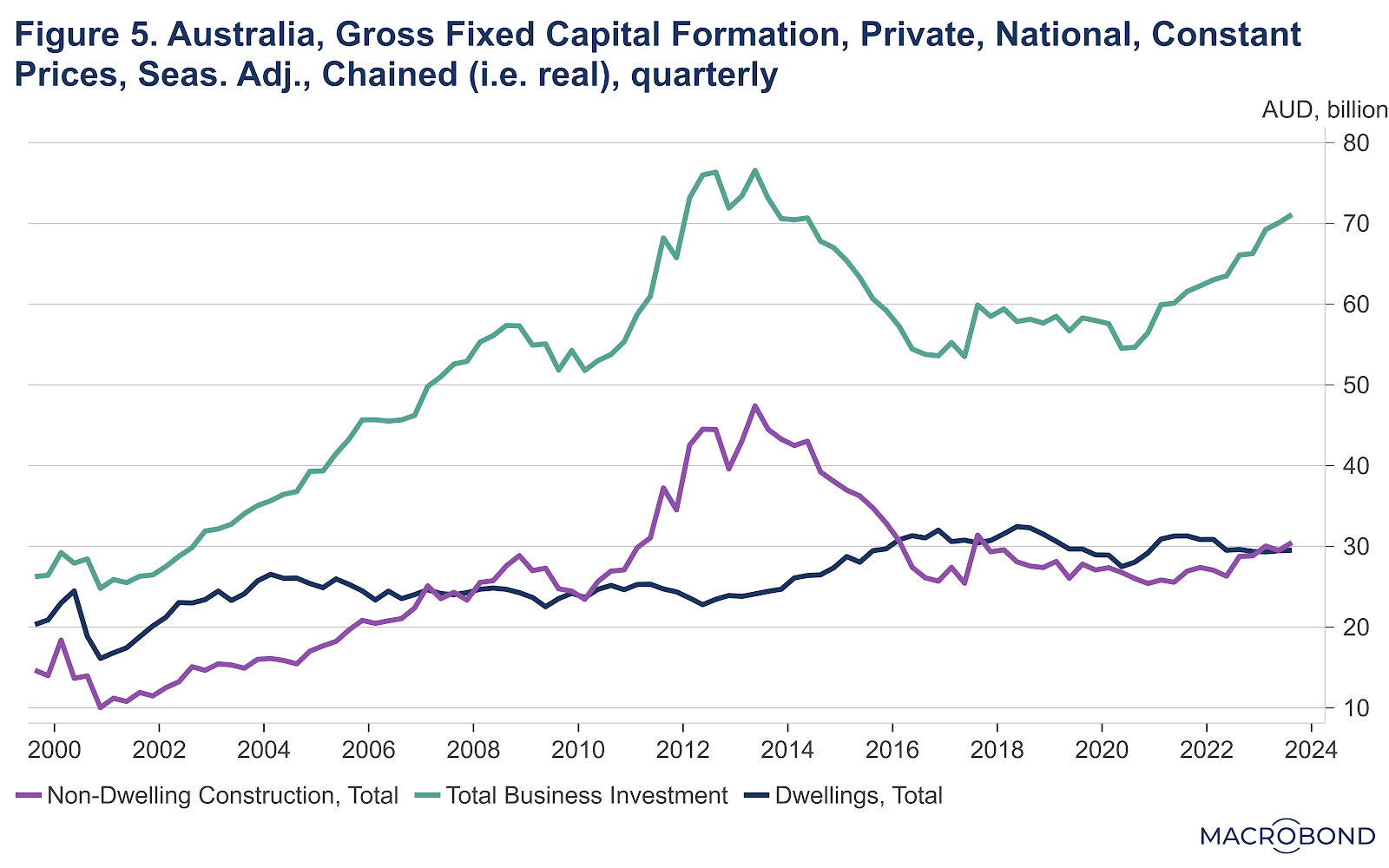

There have been concerns about private sector investment at a national level. Still, the rest of Australia has outperformed Queensland in recent years, particularly regarding business investment (Figure 5). For instance, over the five years to September quarter 2023, private sector capital investment (in real terms) increased by only 5.4% in Queensland compared with an 11.0% increase nationally. Given all the investment opportunities in Queensland in mining, energy, and other sectors, this is a disappointing performance. We should ask whether our regulatory policies discourage and block private sector investment.

We need more business investment if we’re to realise our state’s economic potential and more dwelling investment if we’re to solve the housing crisis. Dwelling completions have been grossly insufficient, given record population growth in numerical terms (Figure 6). We were building nearly 50k new dwellings annually in the mid-nineties, but currently, we’re only managing 30-35k per annum.

The short-term outlook is concerning

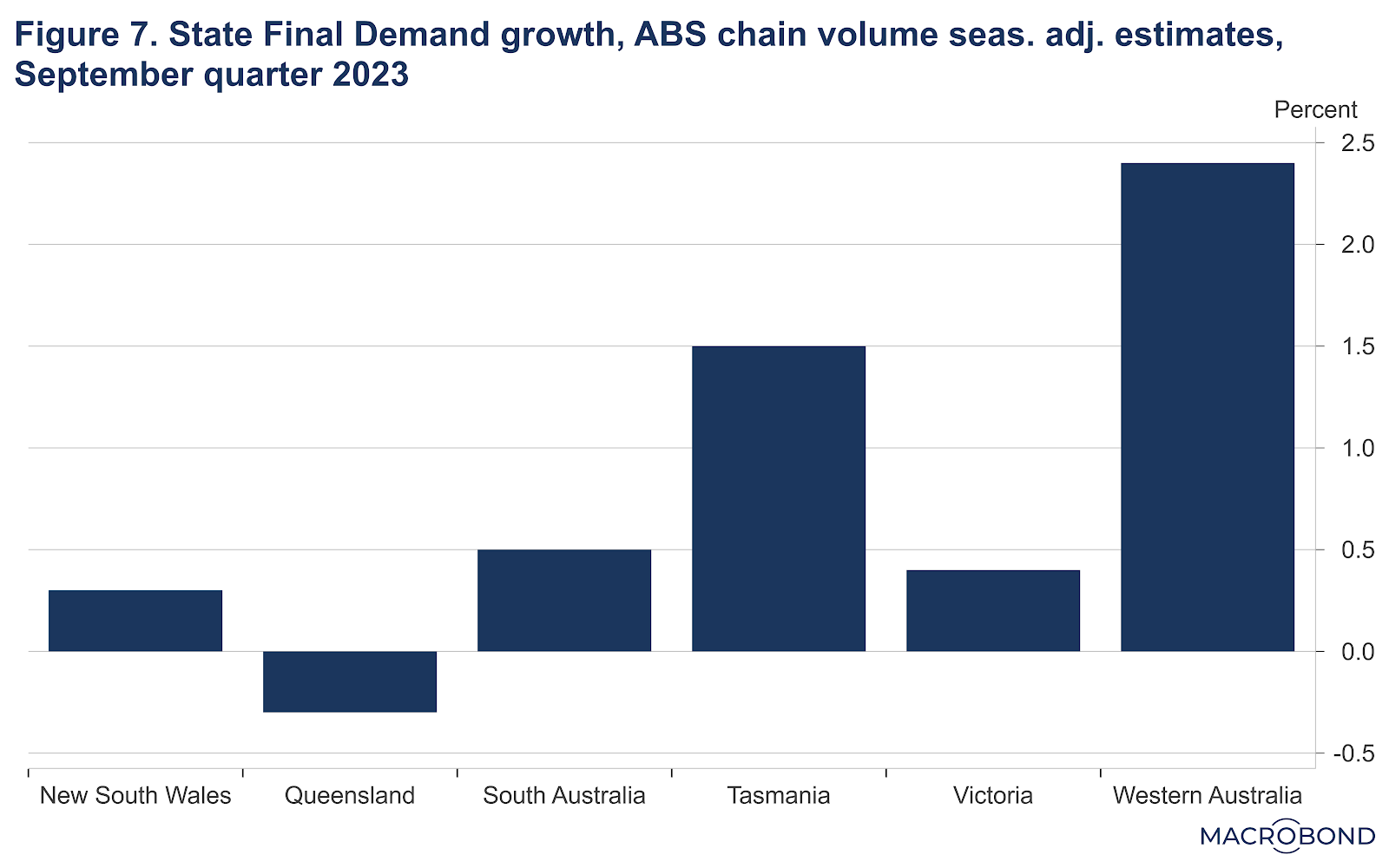

In a future post, I’ll have more to say on the short-term outlook (over the next 12 months). The question is whether the RBA can lock in the immaculate disinflation and avoid causing a national recession. However, as widely observed, it hasn’t avoided a per capita recession. For now, I’ll just note that the September quarter 2023 State Final Demand figure was a shocker, with Queensland being the only state to experience a contraction, due to declines in household consumption and private and public capital investment spending (Figure 7). As usual, I don’t want to overreact to one set of figures, so I will reserve any further commentary until I look closely at all the relevant data.

Please feel free to comment below. Alternatively, you can email comments, questions, suggestions, or hot tips to contact@queenslandeconomywatch.com. Also, please check out my Economics Explored podcast, which has a new episode each week.

Timely analysis Gene. Looking forward to your further posts.

Thanks, Graham!