The big economic question for 2023 is how much the Australian economy will slow down in response to interest rate increases, regarding which we should expect more to come. Queensland’s economy will benefit from a high-performing mining sector, but there’s little doubt we’ll slow down, too.

The federal budget forecasts GDP growth in 2023-24 of 1.5%, down from 3.25% in 2022-23. Australia’s population is forecast to grow 1.7% in 2023-24, which implies a slight fall in per capita GDP. Behind the slowdown is a reduction in dwelling construction (-3.5% change) – off the recent peak associated with pandemic-related stimulus – and a reduction in consumer spending growth to 1.5% in 2023-24, down from 5.75% in 2022-23. If the slowdown is worse than expected, it will be because the Treasury, and the RBA for that matter, have underestimated the impact of rate rises on consumer spending.

We know retail turnover in real terms is falling as households cut back on purchases of durable goods. This is likely due to a combination of rising prices, interest rate increases, and Australians returning to overseas holidaying. Queensland experienced the largest fall in the March quarter with real retail turnover falling 2.2% compared with a national average decline of 0.6% (Figure 1).

Queensland’s larger proportionate fall is likely related to domestic overnight tourism spending starting to fall from very high levels as Australians returned to holidaying overseas (see Pete Faulkner’s recent tweet below), rather than to Queenslanders being disproportionately affected by interest rate increases.

Both nationally and in Queensland we’ve seen two consecutive quarterly falls in real retail turnover. We should have expected some falls as inflation reduced the real value of money balances held by households. To an extent, this needed to happen to unwind the excessive monetary stimulus the RBA undertook during the pandemic. Incidentally, my friend and former Treasury colleague Rob Ewing, who is now a senior official at the ABS had an excellent LinkedIn post on whether we’re in a consumer recession at the moment, arguing it’s too soon to tell given retail turnover excludes a lot of services spending.

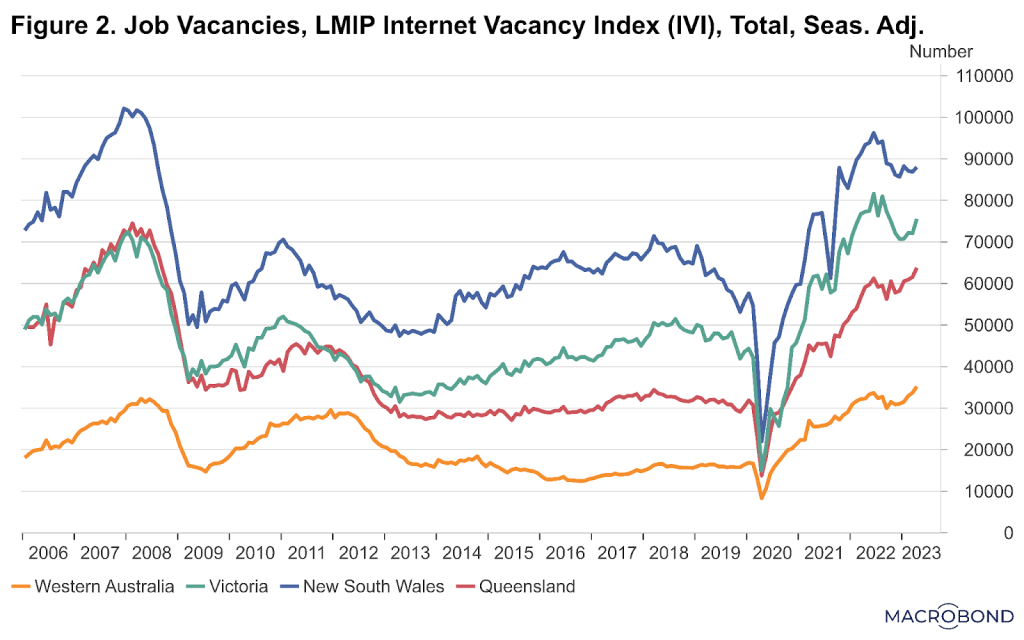

One sign of optimism is that the jobs market has been robust so far this year, according to vacancies data which are available up to April. Job vacancies remain at high levels (Figure 2). In Queensland, the number of job vacancies is around twice the average in the years before the pandemic.

A lot depends on how many more interest rate increases from the RBA we need to endure. This is a great unknown. Christopher Joye made a strong case for further increases in the Financial Review last week, based on our central bank policy rate being lower than that of the US Fed and our inflation being higher. Still-accelerating services inflation, at its highest rate since 2001 according to the ABS, is definitely a concern. The Australian economist with the highest year-end RBA cash rate forecast is also one of Australia’s top economic forecasters, Morgans’ Michael Knox, who may well be correct that we end up with a cash rate of 4.85% at year’s end. That is, Michael expects the RBA will hike four more times this year, one full percentage point of interest rate increases up from the current 3.85% cash rate. If it’s forced to do that, the landing may not be soft after all. You can check out Michael’s analysis via this link:

AUS_ESQ_230502 Why the RBA raised rates.pdf

So expect interest rates to continue rising and household consumption spending to slow down even further, possibly to a significantly lower growth rate than the Treasury’s forecast of 1.5% in 2023-24. The interest bill faced by households has been sharply rising, and more increases are to come, particularly as more-and-more fixed rate housing loans move onto variable rates over the rest of 2023 (Figure 3).

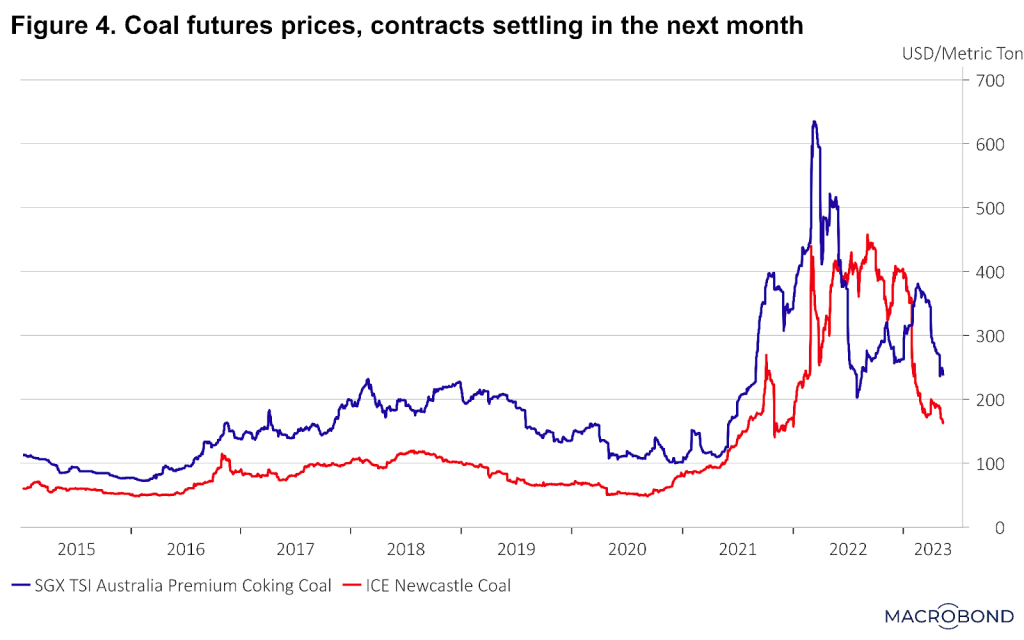

Queensland’s strong resources sector will help support Queensland’s economy, and along with faster population growth, we should experience a milder downturn than other states. In four weeks’ time, Cameron Dick, probably Queensland’s luckiest-ever Treasurer, will hand down the latest state budget and reveal just how much coal royalties have contributed to the budget. QRC estimates it could be $13 billion this financial year due to the very high coal prices we’ve had since Russia invaded Ukraine (Figure 4).

That said, investment in new coal mines is being stifled by government regulations (see Two proposed Qld coal mines axed by federal government). More broadly, even though they’re hiring because business conditions have been strong, Queensland businesses are concerned about the economic outlook and may have some reluctance to make capital investments (Figure 5). The net balance of confidence is the difference between the percentage of businesses that are confident in the future and the percentage which are not confident. In Queensland, that balance is negative, with more businesses not confident than confident, according to NAB survey data.

A fall in business capital investment will likely be a major contributor to any future recession. At the moment, Treasury is forecasting growing business investment nationally in 2023-24, with 2.5% growth overall. Mining investment is forecast to grow by 2%, and non-mining investment is forecast to grow by 2.5%. If economic conditions deteriorate substantially toward the end of 2023, as they possibly will do as more households come off fixed interest rates, business investment could begin plummeting. This is a big unknown and one of the most challenging things to forecast. Overall, we need to wait and see how households cope with higher interest rates over the rest of the year. Treasury and the RBA are hoping households will have sufficient savings that they will not have to cut back their spending too much.

I’ll be thinking more about the economic outlook in preparation for a talk I’m giving on Friday. If you’re in Brisbane, please consider getting a ticket to the long lunch at Phil DiBella’s Coffee Commune I’m speaking at. Ticket sales close Wednesday morning at 10am.

Please feel free to comment below. Alternatively, you can email comments, questions, suggestions, or hot tips to contact@queenslandeconomywatch.com. Also please check out my Economics Explored podcast, which has a new episode each week.