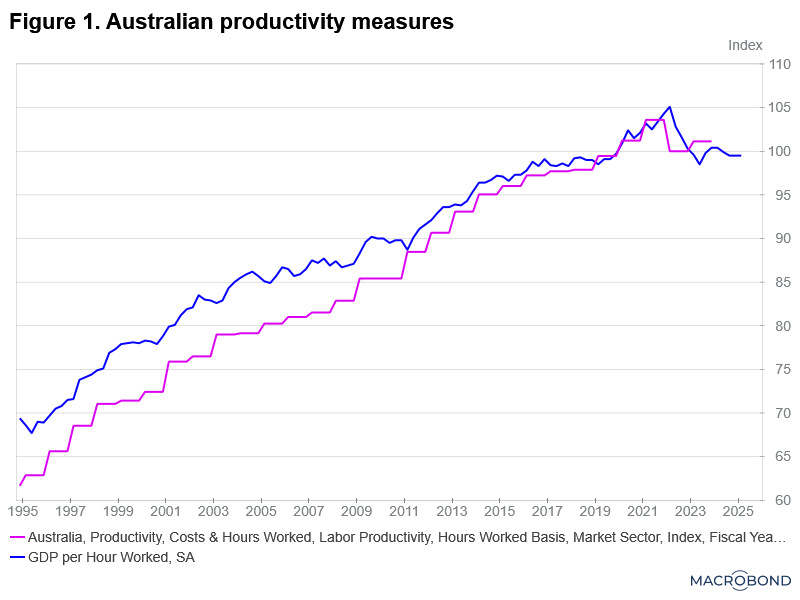

In our latest Australian Taxpayers’ Alliance (ATA) livestream, ATA Chief Economist John Humphreys and I dissect the causes behind Australia’s productivity slump (Figure 1), analysing recent GDP data and the impacts of labour market policies, regulatory constraints, the high cost of energy, and ‘capital shallowing’. A big part of the story is no doubt the rapid expansion of the government and social services sectors, including the NDIS, we’ve seen in recent years, along with an immigration surge that has seen much job creation in low-paying service sector jobs (e.g. Uber Eats delivery drivers).

In our wide-ranging conversation, John and I debate whether tax cuts should precede spending cuts, and we question the effectiveness of government intervention (i.e. ‘picking winners’) in driving innovation. Alas, the interventionist “Future Made in Australia” agenda appears to be the preferred approach of the current federal government.

Furthermore, the Government has ruled out considering IR changes at its upcoming productivity roundtable. This is unfortunate because IR regulations inhibit the adoption of flexible and productivity-enhancing work practices. A couple of decades ago, but in still relevant research, my teammates in Treasury’s Macroeconomic Policy Division identified Australia’s IR regulations as a significant contributor to our productivity gap with the US (see Jyoti Rahman’s paper Comparing Australian and United States Productivity).

My favourite part of the conversation is around 45-50 minutes into it, where John laments that much of the tax reform discussion isn’t about lowering taxes, but instead raising revenue in a more efficient way to pay for runaway public spending:

“Jim Chalmers was saying, Well, look, we’re trying to change the super tax…people are blocking me, so maybe they don’t believe in tax reform. And my jaw hit the floor. So, Jim Chalmers’ vision of tax reform is to introduce a new tax…I mean the opposite of that. I mean, we cut taxes. So that’s what worries me, that’s their vision. And the other, the standard thing, coming out of the Grattan Institute approach is we need tax reform because we have all of this runaway spending, and we need to pay for it somehow.”

John and I aim to make this a regular weekly livestream, so please tune in next Thursday at 7.30. You can watch our conversation on productivity via the YouTube player below or listen to the audio version via the embedded player.

These are personal views and shouldn’t be attributed to any organisation with which I have an association. Please feel free to comment below. Alternatively, you can email comments, questions, suggestions, or hot tips to contact@queenslandeconomywatch.com.