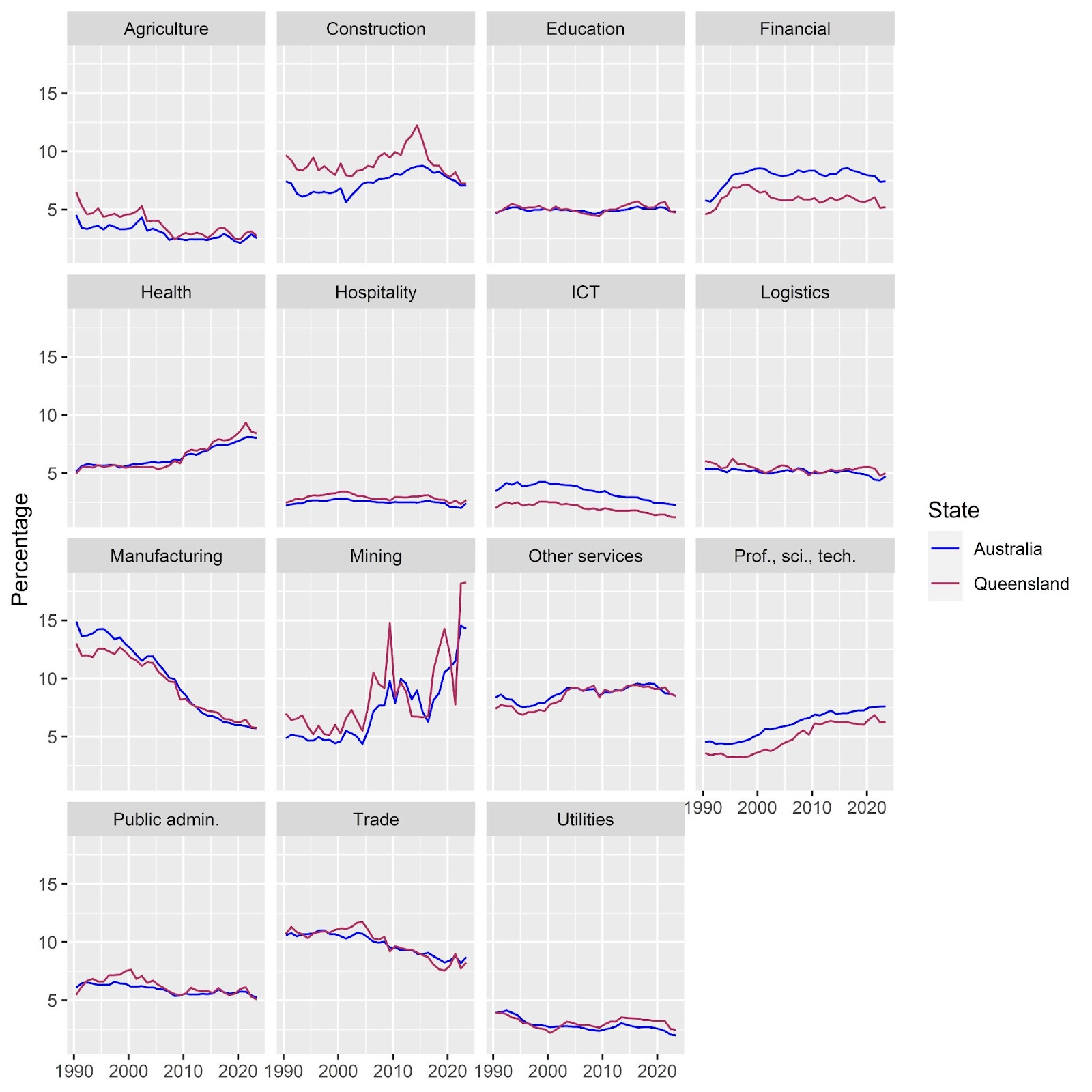

The state and national economies have experienced similar trends by industry since 2000. The big changes have been the 2-3x increase in the mining sector’s importance since China’s economic growth started significantly influencing the global economy in the early-2000s (Figure 1). Because of the massive growth in mining in WA, too, the nationwide mining share has surged as well as that of the mining states. Services sectors such as health and professional, scientific and technical services have also expanded strongly relative to other sectors.

Figure 1. Shares of total industry gross value added by industry division, 1989-90 to 2022-23

Source: ABS State Accounts, 2022-23. Note: shares are calculated using the current price data for each financial year.

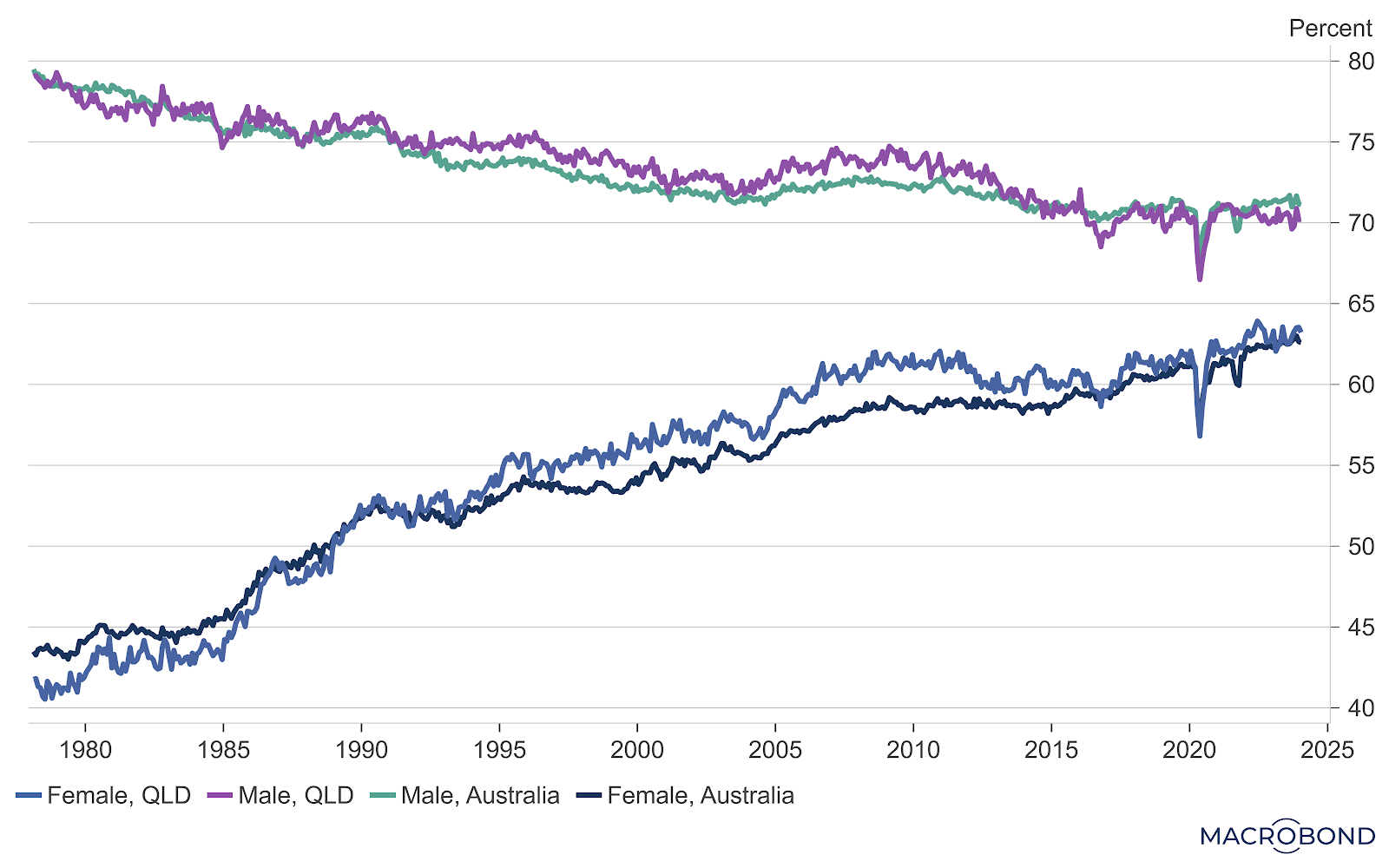

The expansion of services sectors has been assisted by an increase in the female workforce participation rate in recent decades, although the bulk of the increase was over the 1970s to 1990s. This trend has been offset partly by declining male participation (Figure 2).

Figure 2. Labour force participation rates

Source: ABS Labour Force.

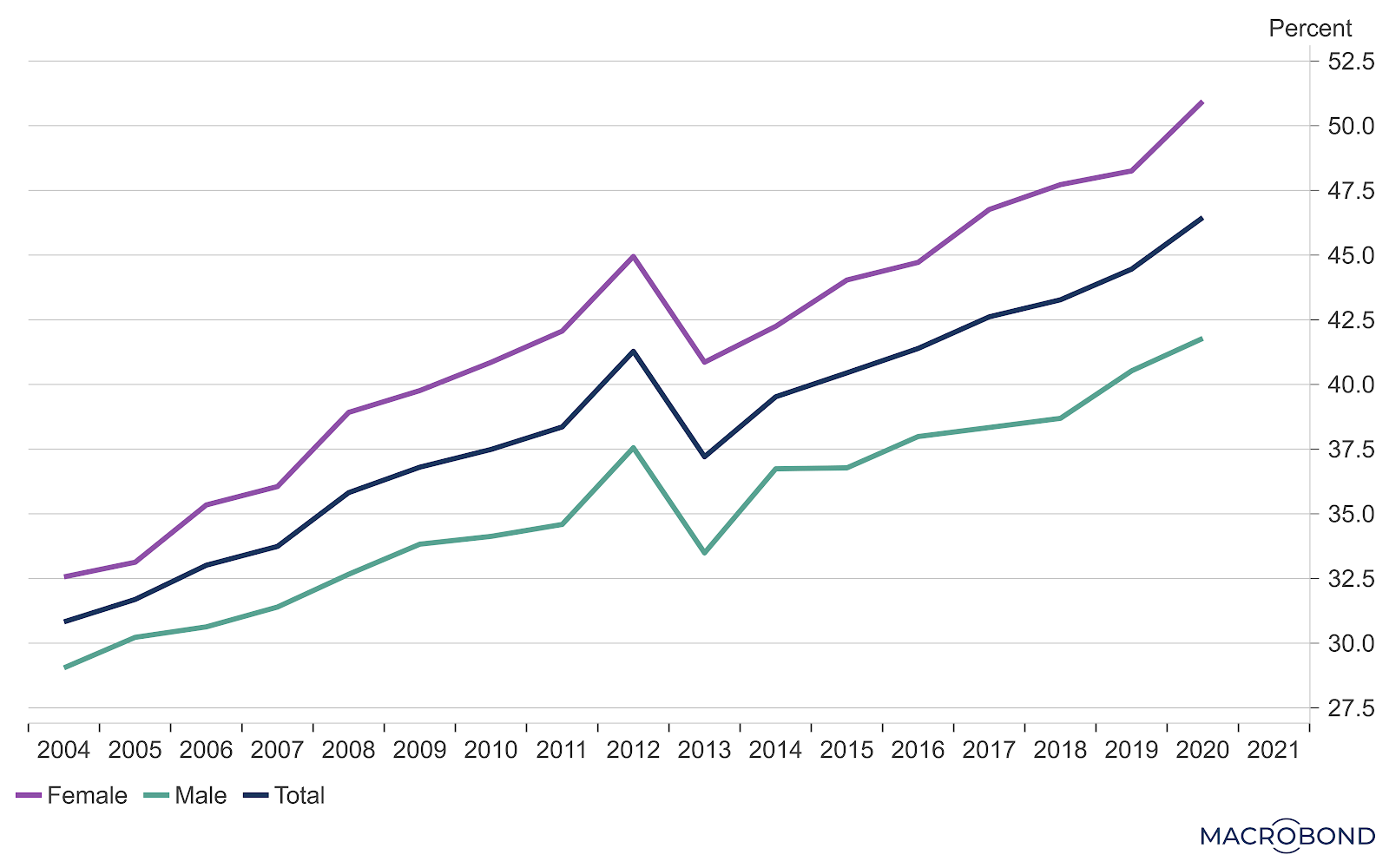

Also supporting the expansion of services sectors has been increasing levels of educational attainment (Figure 3). This has been a positive trend, but there are concerns over credentialism and people not using their tertiary education in their jobs. Also, given current skills shortages in construction, one wonders whether too many people have gotten university degrees rather than trade qualifications.

Figure 3. Educational Attainment, Proportion of people 25+ who have at Least Completed Short-Cycle (at least 2 years) Tertiary, Australia

Source: World Bank, World Development Indicators.

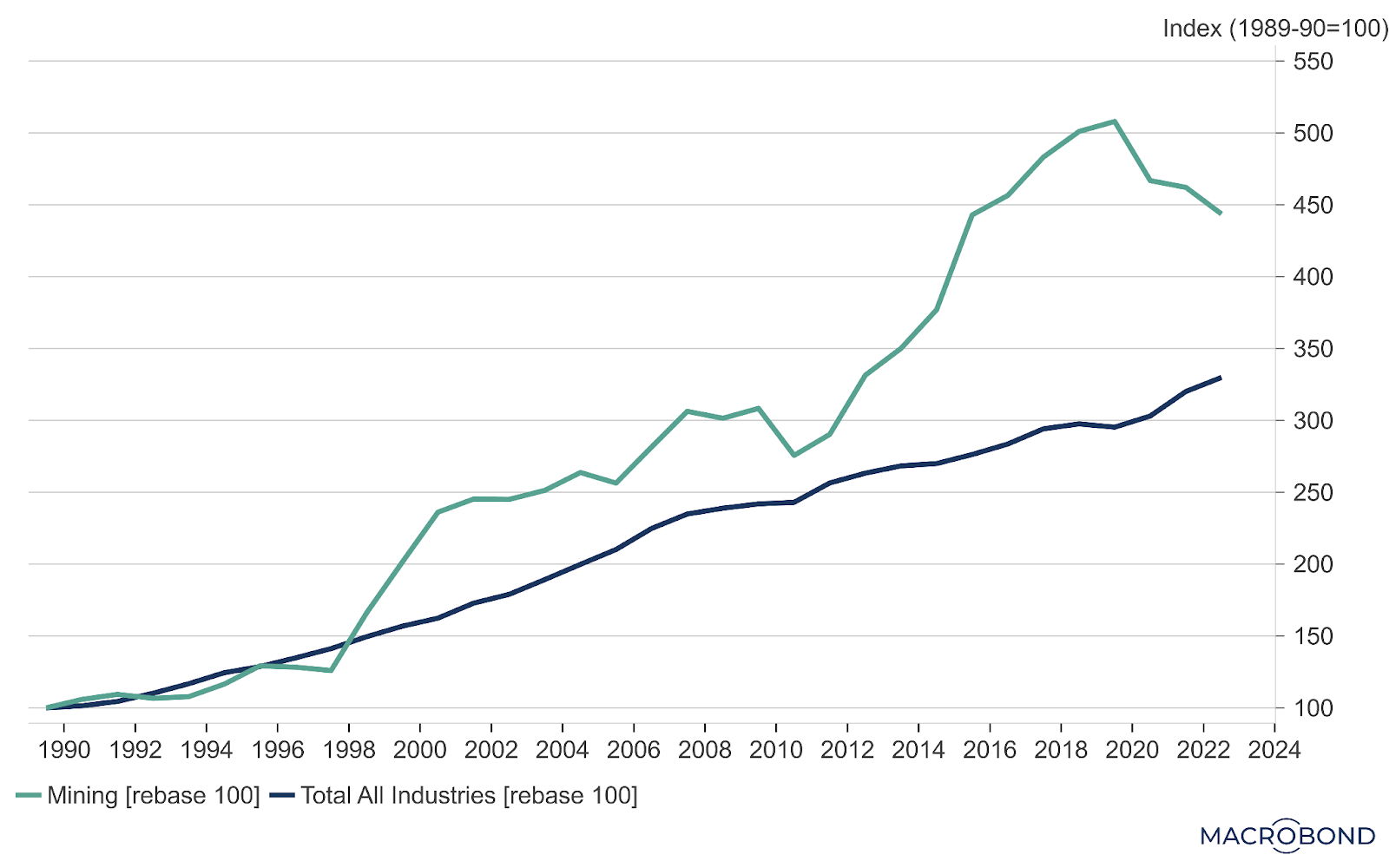

Regarding mining, compare the growth of mining in Queensland with all industries in Figure 4, which shows chain volume or real (inflation-corrected) value-added estimates. This confirms the surge in mining is both a price and volume story. We’ve expanded our production substantially in recent decades and taken advantage of higher commodity prices at times.

Figure 4. Industry value added in mining versus all industries, Queensland, chain volume measures

Source: ABS State Accounts, 2022-23.

In contrast, Agriculture and manufacturing have declined in relative terms, and indeed manufacturing has flatlined in absolute terms since it peaked in the first decade of this century (Figure 5). Volatility in the agricultural sector makes it hard to discern the long-term trend, but arguably it is still positive. Part of the upward trend would be the shift to higher-value crops in many regions, such as macadamias replacing sugarcane on many fields in Bundaberg.

Figure 5. Agriculture and manufacturing gross value added, chain volume (i.e. real) estimates

Source: ABS State Accounts, 2022-23.

Because of the disproportionate importance of mining in Queensland, it makes sense that some other sectors have contributions to the state economy lower than in the rest of Australia. All the shares have to add up to 100% after all. Financial services, ICT and professional, technical and scientific services have shares noticeably below those in the rest of Australia.

As I noted in the Queensland Future State report that I co-authored with Peter Faulkner for ANZ last year:

“Historically, NSW and Victoria have been home to more corporate headquarters than Queensland and this has been reflected in proportionately more professional jobs based in southern states. ABS data on businesses by employment size and main state of operation show, at the end of the 2022 financial year, Queensland had 784 businesses with 200 or more employees, compared with 1,672 in NSW and 1,238 in Victoria. NSW had 2.1 times and Victoria had 1.6 times more large businesses than Queensland, even though they had only 1.5 and 1.2 times the population of Queensland, respectively.”

Luckily, we have a strong resources sector which helps compensate for any relative lack of vigour in other sectors. I’d like to see higher-valued services sectors increase their shares of the Queensland economy. Still, governments shouldn’t deliberately try to engineer that with activist industry policy. I think the best thing to do is to focus on improving our education system and aiming for as competitive a taxation system as possible. Thankfully, Queensland still has lower-than-average state taxation, but we lost our title as the lowest-taxing state during the Beattie years (see Julie Novak’s paper Queensland the low tax state). It would be good to aim for that title once again.

To conclude, I have great optimism for Queensland in the future, but we can clearly do some things better, and there are short-term economic concerns, as I discussed in The Queensland Economy Post-Palaszczuk.

Please feel free to comment below. Alternatively, you can email comments, questions, suggestions, or hot tips to contact@queenslandeconomywatch.com. Also, please check out my Economics Explored podcast, which has a new episode each week.