The Brisbane Times this morning draws attention to the relatively low level of heavy or engineering construction activity (e.g. on roads, bridges, dams, etc) being undertaken for the public sector in Queensland at the moment, based on analysis by RPS’s Mark Wallace. It is reported that:

“Future generations will rue present governments’ reluctance to borrow money to fund infrastructure, a multinational consultancy has warned as Queensland’s public spending sank to a 10-year low.

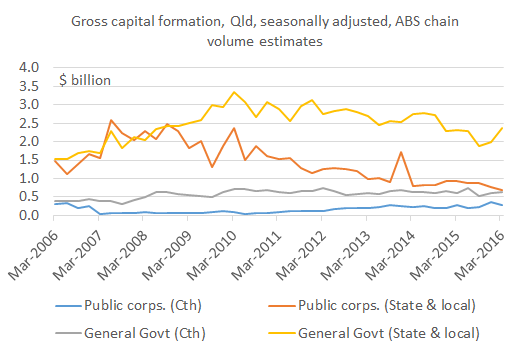

An RPS Group analysis of Australian Bureau of Statistics data showed the public sector spent $1.3 billion on infrastructure in the March quarter, which was the lowest level since 2006 and half the rate of expenditure seen five years ago.”

Public infrastructure spending is certainly at relatively low levels, but some context is needed. First, the very high levels of expenditure in the years around 2010 were unsustainable. Second, focusing on engineering construction ignores the full range of capital expenditures by government, including on schools and hospitals, for example. Indeed, the broader National Accounts measure of public capital expenditure, public gross fixed capital formation, has recently started growing again in Queensland (see charts below).

We should not make a fetish of heavy infrastructure and consider it superior to other types of infrastructure, the so-called social infrastructure represented by schools and hospitals, for example. Indeed, a lot of heavy infrastructure investments made by government in recent years have turned out to be questionable, including desalination and recycled water plants we do not need, and a new dam, Wyaralong, that is not connected to the SEQ water grid. So commentators should be careful what they wish for regarding infrastructure. We do not need more white elephants in Queensland.

Excellent points Gene. Once again salivating project proponents (or their agents) looking out for themselves rather than the people of Queensland.

Thanks, Smokin Joe!

Gene

Great post.

Given the fact that RPS make most of their money from the mining, energy, infrastructure and urban growth (more infrastructure) sectors, I think we can safely file the report under ‘thinly veiled rent seeking’.

But putting the rent seeking aside for a minute….

The case for using past expenditures as a way to justify future capital expenditure levels is pretty dubious at best, and probably pretty dumb when it comes to engineering construction. Projects are lumpy and driven by cycles (e.g. mining boom, millennium drought triggered over $20B in water infrastructure projects), so why expect smooth and consistent growth?

And with other infrastructure like roads, after building theses things for over 150 years in Australia, isn’t it reasonable to assume that all of the genuine priority road infrastructure is now developed, and there will be diminishing marginal returns from additional development of roads? Shouldn’t that make us suspicious if expenditure on new roads just keeps growing, and there isn’t a proper benefit-cost analysis on these projects to be seen?

Absolutely, Jim. Thanks for the comment. I thought about your previous comments on this issue when writing this post.

Several new “priority road” construction projects going on in Sydney such as WestConnex and NorthConnex. Lots of new people in need new roads (or extensions). How can anyone realistically do a Cost-Benefit on a priority road which will be in used for 50 or 100 years or more? That would be stretching the theoretical and academic basis for the CBA analysis beyond what it was designed to do. In the past I’ve also said this about major historical rail projects such as the Sydney to Newcastle line. So I think it’s pushing it a bit to apply a CBA to these major projects blindly ignoring the very long term benefits (how they can be measured I don’t know, but ignoring them is a potentially major economic cost in itself just as building up debt blindly is imposing a potentially major cost on future generations). Obviously a motorway from Sydney to Broken Hill is silly, but a rail line extension to South West Sydney makes sense as we can be confident it is a priority growth area and will be used in 50 years time. How can anyone perform a CBA analysis a 50 or 100 year benefit and costs with a straight face? This is where I suspect the technocrat (as Ross Gitten’s likes to call them) economists apply theoretical techniques ignoring the caveats and underlying basis of techniques developed by academics. It’s time for technocrat economists to listen to the people who created these techniques they are so fond of using and ease up a bit on the strictness of application. The most obvious candidates for Queensland heavy engineering construction in my mind are a heavy rail extension to the NSW border (and possibly into Tweed Heads which is likely to see fast growth over the next 50 years), and upgrades to the M1 and M5. Low interest rates? Time for shovel ready infrastructure building which will build a productive Queensland economy to meet its needs in 50 and 100 years time. PS – Sydney’s doing it.

I note some academic research, such as by David Evans (Oxford Brookes University), have tried looking at uncertainty in the social discount rate and exploring the conditions favouring the application of higher present value welfare weights. In a paper from 2009 Evans looked at social time preference rates and alternative plausible probability distributions used to explore the future time paths for discount factors. So even the academic “experts” are grappling with these issues for very long term projects. How technocrat economists can be so sure of themselves when they perform CBA analysis of projects I wonder. I’m not aware of such rigorous and up to date techniques being used by government agencies for very long term projects which may bring very long term benefits to the economy, but am happy to be corrected.

If these up to date techniques are not being used by government agencies, then potentially many very long term projects will have their economic benefits low and may not proceed leaving a poorer economy.

Article is – David Evans, (2009) “Uncertainty and social discounting for the very long term”, Journal of Economic Studies, Vol. 36 Iss: 5, pp.522 – 540

Thanks Alistair for your very interesting comments. I’ll have a read. My feeling is that at any plausible real discount rate costs and benefits beyond fifty years time are negligible in present value terms for the vast majority of projects.

It’s a problem with very long term projects. I suspect we leave the realm of current economic theory and knowledge and move towards areas where planners and futurists are in their fore. That area is highly uncertain and can’t be accurately measured, a concern to many economists, particularly technocrat economists. However, by the same logic, if companies only produced goods solely based on a CBA with costs, benefits and discount rates that can be reliably measured then many inventions with major economic benefits would’t exist. Some inventions and innovations do take a long time such as the jet engine, quantum computing, nuclear medicine, etc. Would Otto Hahn and his assistant Fritz Strassmann have performed their nuclear fission research in 1938 if they had performed a CBA? I suspect not. But I don’t think we can imagine a world without it and all the economic benefits that flowed from it. Sometimes the benefits don’t emerge over a very long time frame. If we assume real discount rates are low over the long term then these projects wouldn’t have been developed and we wouldn’t be enjoying the numerous economic benefits today if they were solely based on a CBA I suspect. Same goes for some of these very long term projects, yes don’t construct obviously silly projects such as a motorway from Sydney to Broken Hill (or a High Speed Rail line along the east coast, or desalination plant), but be conscious of uncertainty and be a bit more risk taking with the more reasonable projects. Short term and medium term projects are good candidates for a CBA, but not long or very long term projects. The question is how much risk to accept in a project. I don’t know the answer, but I am concerned at the seeming hostility towards risky longer term projects. If those risky heavy engineering projects are not constructed I suspect we will all be for the poorer.

Alistair

Lots of interesting points (many I agree with). I’d just make a couple of (rant-like) comments to add to the discussion.

Good technocrats do use appropriate discount rates…

As one of those technocrat economists that primarily work on social issues, we typically use low social discount rates as either a base case or as part of sensitivity analysis (including applying the Ramsey approach). Many of the issues we deal with (e.g. climate change) are inter-generational or relate to public goods. Therefore using a discount rate based on the WACC doesn’t really make sense.

Use of artificially-low social discount rates for projects that deliver private benefits is probably questionable…

You have highlighted some examples of urban road projects in Sydney (WestConnex and NorthConnex) that may pass the BCA test; but I don’t recall one being done. Readers of this blog will remember some pretty scathing posts on the Kingsford Smith Drive (KSD) upgrade in December last year. I replicated the BCA for that project at the time. I just re-ran the model on the KSD project, and it needs a discount rate of 3% or lower to stack up.

I guess my question is, for road projects that are justified on the basis of diffuse private benefits (saved time as a proxy for congestion costs and vehicle operating costs), how low below the risk-free cost of capital is a justifiable rate? I don’t know, but I don’t see there is a strong argument for using artifically-low social discount rates for publicly-funded projects that provide private benefits.

Are we inadvertently incorporating optimism bias into investments for urban transport infrastructure projects?…..

I can’t recall one demand forecast for any of the mega toll roads/bridges/tunnels in Queensland that has actually been met, particularly once the full toll has been imposed. Isn’t it time to concede that commuters don’t value delays in commute time at the wage rate, so we should replace the ‘optimism bias’ in our modeling with a ‘realism bias’? I’m not saying we shouldn’t invest in the projects, but I am saying we should do the forecasting a lot better as that drives the investment decision.

I agree that estimating long-term benefit streams is notoriously hard. But often for urban transport infrastructure projects, economists resort to history as a proxy predictor of the future (e.g. transport trip generation to the CBD is based on population growth forecasts). But there is lots of evidence to suggest many of the jobs that are currently in our CBDs will disappear or potentially relocate to lower cost locations in the next 15-20 years due to technology (less while collar jobs, less retail jobs, relocation or outsourcing of back-office functions etc.). So shouldn’t we be incorporating plateaus or potential declines in trip generation in the longer-term into our forecasting (call it a ‘pessimism bias’)?

The bottom line is that the economic returns to thinking harder are probably better than the economic returns to spending taxpayers money on concrete and steel in many cases. But as a Transport Minister once said to me when I showed him a particular infrastructure project could be avoided altogether by changing a shipping timetable…… “I can put a plaque on some infrastructure, but I can’t put a plaque on a good idea, and there is an election coming up.”