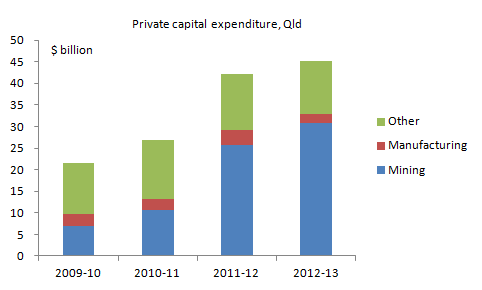

Yesterday’s ABS capital expenditure data show just how significant resources sector investment has been to the Queensland economy over the last few years, and how the manufacturing sector has been affected by the high exchange rate (see chart below).

While the forward-looking expected investment data are not encouraging (as covered by MacroBusiness), I agree with Pete Faulkner’s conclusion that CAPEX data confirms the “soft-landing” scenario:

While the forward-looking expected investment data are not encouraging (as covered by MacroBusiness), I agree with Pete Faulkner’s conclusion that CAPEX data confirms the “soft-landing” scenario:

Data released this morning by the ABS shows that private sector capital expenditure (both actual and expected) are not falling off a cliff as the mining boom comes to its natural end. As we noted last quarter (see here), although the slow down in the mining sector is clear it is nowhere near as dramatic as some would have us believe.

Regarding the impact of the resources boom on manufacturing, see my earlier post:

Qld struck by Dutch Disease – manufacturing employment has plunged in last few years