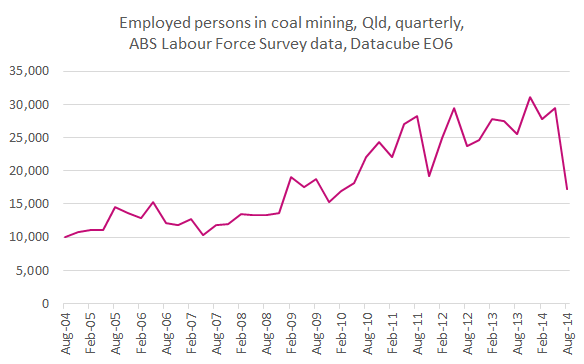

The big economic news for Queensland today was the announcement from BHP Billiton of a reduction in coal mining jobs of 700 in its Central Queensland operations, as the viability of some operations have been challenged by lower coal prices (see 700 Queensland coal mining jobs go at BHP’s BMA joint venture). This follows a series of coal mining job cuts this year, which appear to have been reflected in the August ABS employment by industry data released last week (see the chart below). While the plunge may be exaggerated due to sampling error in the Labour Force Survey, there is no doubt coal mining employment is falling significantly. The Premier is right to talk positively of the employment potential of Galilee Basin projects, but I think the time-frames for these projects means that any big employment boost is a few years away yet. In the meantime, there’s not much cause for optimism – MacroBusiness is particularly pessimistic (Coal mining job losses roll on) – and the Queensland Treasury might have to consider revising down its coal royalties forecast of $2.1 billion in 2014-15.

-

Join 1,182 other subscribers

-

Recent Posts

- AI, Productivity, and “Infinite Intelligence” – Conversation with Chris Berg and John Humphreys

- Borrowing to Pay Wages

- Interest Rates, Australia’s 3 Biggest Challenges, Global Fertility Crash, & the Tobin Tax Debate w/ John Humphreys, Australian Taxpayers’ Alliance

- Australia’s Productivity Problem: Can It Be Fixed? w/ John Humphreys, Australian Taxpayers’ Alliance

- Big Budget Challenge for New Qld Treasurer

Top Posts & Pages

- Is North Qld under-funded by the State Government relative to the South East?

- How important is the return of leased out assets in 99 years time in a cost-benefit analysis?

- Heat map of Brisbane metro property prices – big opportunities in the Western corridor?

- Qld Treasury right that paying down State debt is a huge challenge

- Comment in Courier-Mail on volatile Qld jobs data

- Driverless cars and congestion charging up for discussion at IAQ Qld Infrastructure Summit 2016

- Fiscal Stimulus with Fabrizio Carmignani - my latest Economics Explored podcast episode

- Mining CAPEX has been growing in WA, falling in Qld

- Fake privatisation of Titles Registry helping Qld Gov’t pretend it has debt management plan

- Qld Govt benefits from volatile jobs data - still vulnerable over bulk of jobs growth being part-time over first term

Archives

- August 2025

- July 2025

- June 2025

- April 2025

- March 2025

- May 2024

- April 2024

- March 2024

- February 2024

- December 2023

- October 2023

- June 2023

- May 2023

- April 2023

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

Categories

- Agriculture

- Arts

- Basin Plan

- Brisbane

- Budget

- Cairns

- China

- Climate change

- Competition policy

- Crime

- Cyclones

- Education

- Energy

- Environment

- Exports

- Floods

- Gladstone

- Gold Coast

- Health

- Housing

- India

- Industry policy

- Infrastructure

- Ipswich

- IR

- Labour market

- Mackay

- Macroeconomy

- Media

- Migration

- Mining

- nfps

- North Queensland

- Population

- Productivity

- queensland

- Queensland Government

- Queensland Rail

- qut

- Retail trade

- Rockhampton

- Social policy

- Tax

- Toowoomba

- Tourism

- Townsville

- Trade

- Transport

- Uncategorized

- VET

- Water

- Wide Bay-Burnett

Blogroll

Jobs losses in the mining sector should be a surprise to nobody. What we have seen in the past couple of years is a transition from the mine development phase (higher employment) to the mine operation phase (lower employment) for the mining develop cycle.

I’d bet there is no positive correlation between recent job losses in mining and production. I’d guess it is probably slightly negative. Reading any causality into this is risky duet where we are in the mining development cycle.

If I was Treasury, I’d be more concerned about changes to China’s coal quality requirements hitting Qld coal sales. Marginal (i.e. higher cost) mines may struggle to secure commercially viable contracts with Chinese buyers in the future.

Jim, I agree regarding the impact of the transition form development to operations, but from what I can tell these are operational jobs that are being cut. While the company appears to be targeting productivity improvements, I’d think total output would be lower than previous expectations. That said, the info in the media isn’t particularly clear on what’s occurring. Thanks for your comment. Good point about China’s coal quality requirements.

Jim, I think you are spot on about the changes in Chinas’s demand profile. But really its hard to be optimistic about coal. Most of us know its peeked and that the stranded asset argument will impact Qld in a big way. It won’t stop coal being mined, but the growth has all but gone. If we are relying on the Adarni project to keep the state afloat we will all have to move to Victoria!

Gene my real question is this: What can Queensland do? I know you are a long-term optimist but we have so few export earners except for Coal and soon Gas.

Thanks for the comment, NSSfT. Most future jobs growth will be in services and there will be huge demands for people in health and aged care, for example. Also, with the mining boom over, the Australian dollar is likely to continue falling, which will be good for tourism. Finally, having a well educated population means we should be able to adjust to and take advantage of changing economic circumstances.